Blogs

Zakat Facts: Zakat Rules, Conditions, and More

17 Oct 2022

Zakat is one of the five pillars of Islam; it is obligatory for every Muslim adult whose saved money has reached the Nisab and remained as is for an entire lunar year.

Also, it is essential to note that there are fixed Zakat rules that facilitate the process of donating Zakat money and distributing it, in addition to certain Zakat conditions that must apply to the Muslim individual, so they are required to pay Zakat.

Donating Zakat is a serious process that faces varying challenges; its value must be calculated accurately, the type of donation should be determined; voluntary contributions in kind or in cash; and its distribution must target people who genuinely deserve it.

Continue reading to discover all Zakat facts you need to know; Zakat rules and conditions, Zakat types, its significance, and more.

What is Zakat?

Zakat was mentioned in the holy Quran, indicating its significance.

Zakat is the third pillar of Islam and is obligatory for all adult Muslims financially capable of donating. Its exact value is predetermined, and Zakat recipients are also predetermined in the Quran, as follows:

“Charities are for the poor, and the destitute, and those who administer them, and for reconciling hearts, and for freeing slaves, and for those in debt, and in the path of Allah, and for the homeless— an mandate from Allah. Allah is All-Knowing, Most Wise.” (9:60)

That makes the foundation for Zakat rules.

Types of Zakat

Each type of Zakat has its own Zakat rules; the following points explore each type generally speaking:

- Zakat Al-Mal: This type of Zakat is obligatory once the Muslim’s savings reach the Nisab, and only if the money remained as is for a lunar year. You can calculate the value and amount of Zakat you need to donate using the special Zakat calculator from the Jordanian General Iftaa’ Department.

- Zakat Al-Fitr: This Zakat is a must for every adult, sane Muslim during the holy month of Ramadan and must be donated before Eid Al-Fitr prayers. The Jordanian General Iftaa’ Department determines its value each year.

- Zakat Over Agricultural Produce: Zakat is a must over agricultural products, and their Nisab equals five units of Wasq, as each Wasq amounts to 130.56 kg of wheat. So, the Nisab of five Wasqs equals 653 kgs. If the products are from irrigated land, Zakat rate is five percent of the net value of harvest, while it is ten percent of the same if the products are from unirrigated land.

You can explore more of the agricultural produce Zakat rules with the Jordanian General Iftaa’ Department.

- Zakah on Rikaz: Rikaz refers to anything hidden in the ground, and if a Muslim finds any hidden treasure, they must pay one-fifth of it immediately as Zakat. This is also according to the Jordanian General Iftaa’ Department.

Zakat Conditions

Zakat is only a must for the Muslim individual if certain conditions apply, and they are as follows:

- Freedom: Zakat is not required of enslaved people.

- Absolute Ownership: The assets that one pays Zakat over must be fully and completely owned by the owner.

- Growth: The assets (money, for example) must provide its owner with profit or be produced by growth, either by gain or acquisition.

- Abundance Above Need: One of Zakat conditions is that one’s money should suffice first for basic needs; food, water, shelter, clothing, and other necessities. One is not obligated to pay Zakat if the money is not above need.

- Reaching Nisab: Money must reach the Nisab, which is the minimum amount required of the Muslim to have to be obligated to pay Zakat.

- One Lunar Year: This last Zakat condition requires that the Muslim’s money maintains in their possession for an entire lunar year to be required to pay Zakat.

Who Receives Zakat?

The recipients of Zakat are determined in the Quran and some of these categories are:

- The poor and needy.

- Zakat administrators.

- Those struggling with debt that they cannot pay back.

- For the wayfarer; all who are stranded or traveling with few resources.

Zakat Significance

Zakat is important for many reasons; it is a way of achieving social solidarity, accomplishing compassion and mercy among Muslim community members, and facilitating good living conditions for those deserving of Zakat.

Zakat is essential because it helps create social safety and security within the community. That is why it should be calculated accurately and distributed only to those who genuinely deserve it.

Based on that, we present four points to consider when donating Zakat.

5 Tips to Follow When Donating Zakat

In addition to Zakat rules that you must follow, the following are five tips to help you donate your Zakat money more effectively:

- Determine the Exact Amount: You should determine the exact amount of money you need to donate using the calculator from the Jordanian General Iftaa’ Department.

- Determine the Recipients: Be particular about who you will donate Zakat money to.

- Investigate the Recipients' State: You should look into the status of those to whom you will donate Zakat to ensure they deserve Zakat. You can ask their neighbors or contact a local organization that has access to needy families. Be sure to keep the search as private as possible, and remember that you can donate Zakat to family members or those you know who occupy low-paying jobs.

- Look for a Local Organization: Instead of looking for Zakat-deserving individuals yourself, you should look for an organization that is licensed and officially recognized, enabling it to receive and distribute Zakat money on your behalf.

Why Should You Donate Zakat through an Organization?

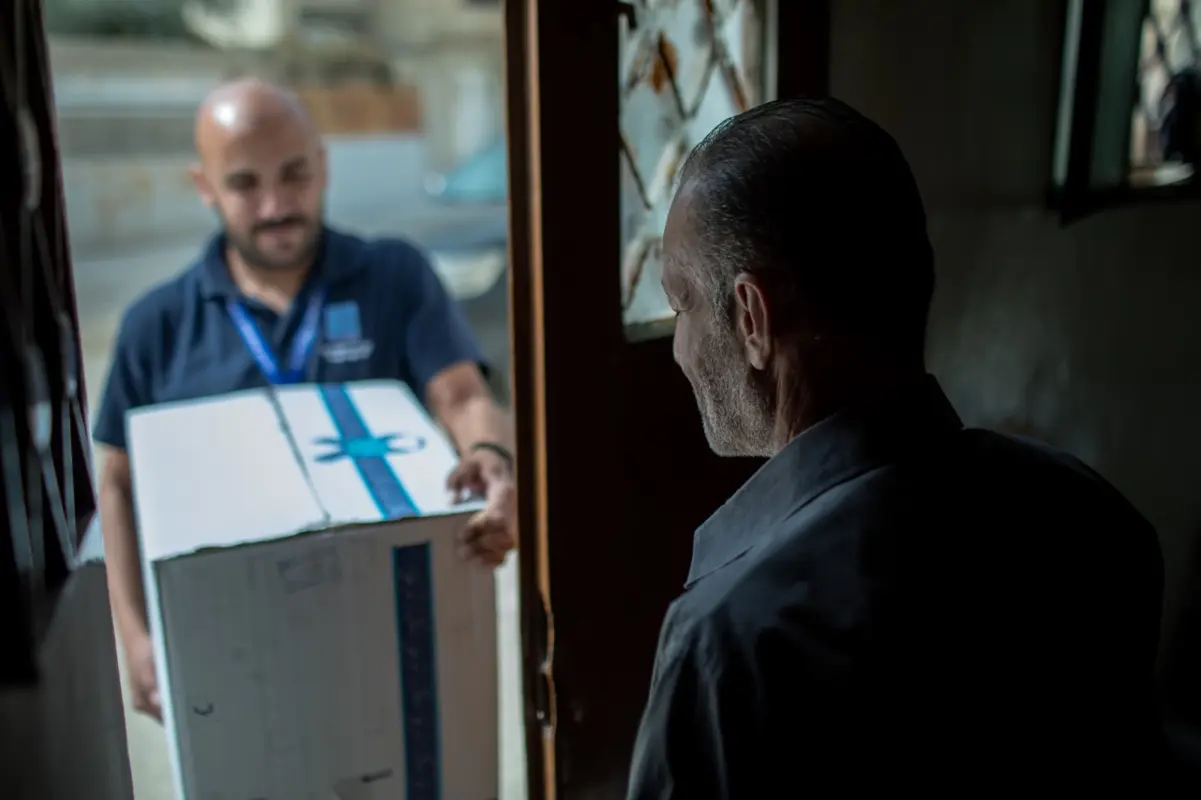

Giving Zakat to licensed organizations saves you time and effort, and it ensures that those receiving the money genuinely need it and deserve it, unlike giving Zakat to individuals yourself.

Organizations receiving Zakat money and distributing it are your best option for the following reasons:

- Trustworthiness: Those organizations look into the status of each case, so they determine those who genuinely deserve to receive Zakat.

- Inclusion: This refers to the organization’s capability of reaching a wider range of people who need help and have the right to receive Zakat.

- Varying Charitable Activities: Organizations can invest Zakat money into many different purposes and activities to help those in need, unlike individual effort that revolves around minimal charitable activities that are short-term due to logistical and financial limitations.

- Longevity: The investments of organizations are more long-lasting and sustainable than those of individuals, as the former’s investments with Zakat money can be part of projects with long-term benefits.

Donate Zakat to Tkiyet Um Ali

Help combat hunger and poverty in Jordan and donate your Zakat money to an officially recognized and licensed organization from the Jordanian General Iftaa’ Department.

Stay informed of the latest blogs

21 Oct 2025

Charity on Behalf of Parents: Virtues and Rewards

22 Sep 2025

The Importance of Donating to Gaza and Its Impact on Improving the Lives of Children and Affected Families in The Strip

11 Sep 2025

How to Instill in Children the Love for Helping the Poor